The new iQOO 15 could boost competition in UAE’s Android flagship space

iQOO 15’s arrival may reshape UAE’s premium smartphone market

The UAE smartphone market is preparing for a potential shake-up as the iQOO 15 edges closer to launch. Known for blending top-tier performance with competitive pricing, this flagship is expected to disrupt the Android space in the region, where brands like Samsung, OnePlus, and Xiaomi dominate. The iQOO 15’s arrival could push these established players to rethink how they price and position their high-end models in the Emirates.

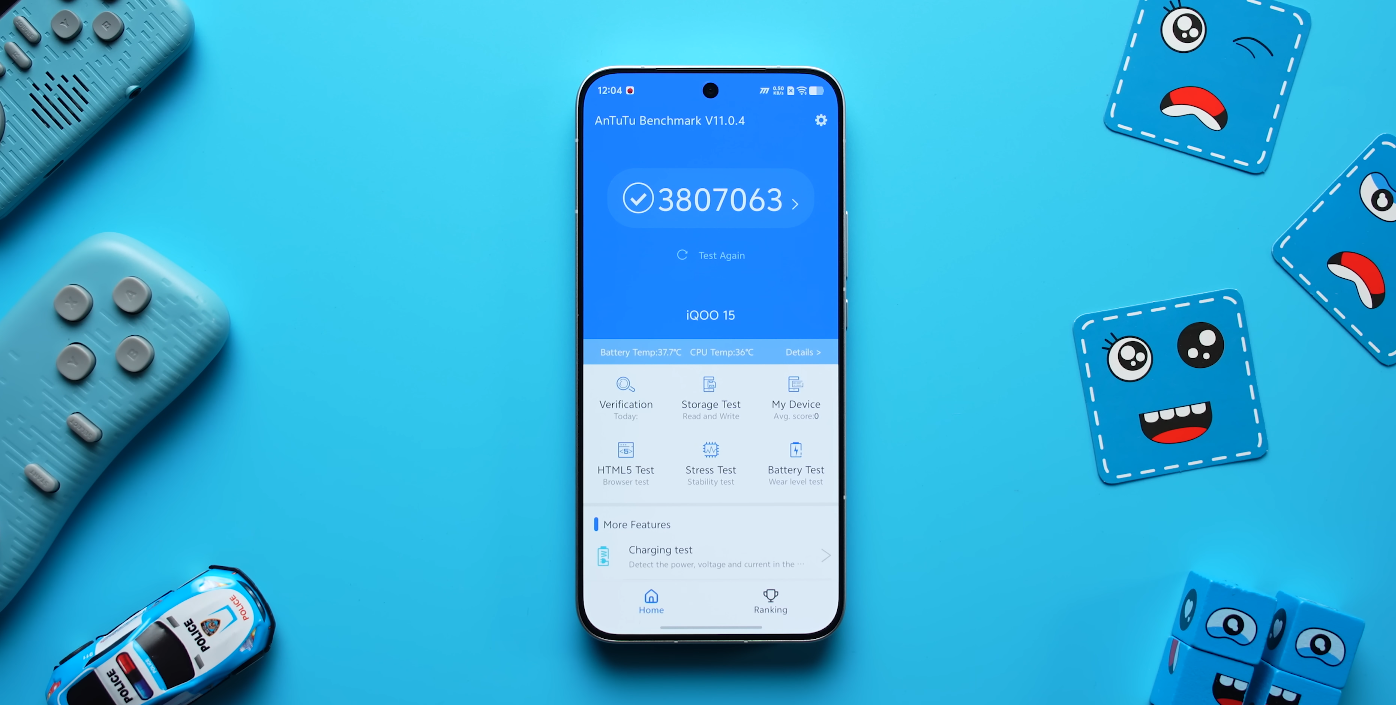

Industry analysts predict that the iQOO 15 will launch in the UAE within the first half of 2026, closely following its debut in China. The phone is expected to arrive with the Snapdragon 8 Elite Gen 5 chipset, a 6.85-inch 2K LTPO AMOLED display, and up to 16GB of RAM paired with 1TB of internal storage. With a 7,000 mAh battery and 100W fast charging support, it offers flagship-grade performance that could appeal strongly to both gamers and tech enthusiasts in Dubai and Abu Dhabi.

The iQOO 15’s biggest advantage lies in its rumored pricing strategy. Expected to retail between AED 2,100 and AED 2,700, it positions itself well below most premium Android rivals that often start above AED 3,000. This competitive price point could attract performance-focused users who want flagship specifications without the flagship price tag, putting direct pressure on brands like Samsung’s Galaxy S24 series and OnePlus 13.

Local market experts note that UAE buyers have become increasingly value-conscious, seeking devices that deliver strong performance and long battery life without overpaying. The iQOO 15’s blend of power efficiency, gaming optimization, and smooth display performance could make it one of the most balanced flagships in its segment. Its arrival may also intensify price-based competition among Android brands, prompting companies to offer more aggressive promotions, trade-in programs, or early-bird deals.

Another factor working in iQOO’s favor is its growing presence in online retail channels across the Middle East. The brand has reportedly strengthened partnerships with major UAE e-commerce platforms, making it easier for local consumers to access new models and official accessories. If iQOO maintains consistent after-sales support and localized software updates, analysts believe it could quickly build trust in a market known for early tech adoption.

However, industry experts also caution that breaking into the UAE’s premium smartphone segment won’t be easy. Consumers in the Emirates value brand reputation and long-term service reliability as much as technical specs. For iQOO to truly compete with giants like Samsung and Apple, it must demonstrate that it can provide dependable customer support and maintain steady availability across major cities.

Still, the overall sentiment remains optimistic. The iQOO 15’s entry into the UAE market represents more than just another product launch — it signals growing diversity and competition within the Android flagship category. As manufacturers race to offer more performance at lower prices, UAE consumers are likely to benefit the most from this shift. If iQOO delivers on its promises, it may not only challenge existing flagship models but also redefine how performance smartphones are priced in the region.