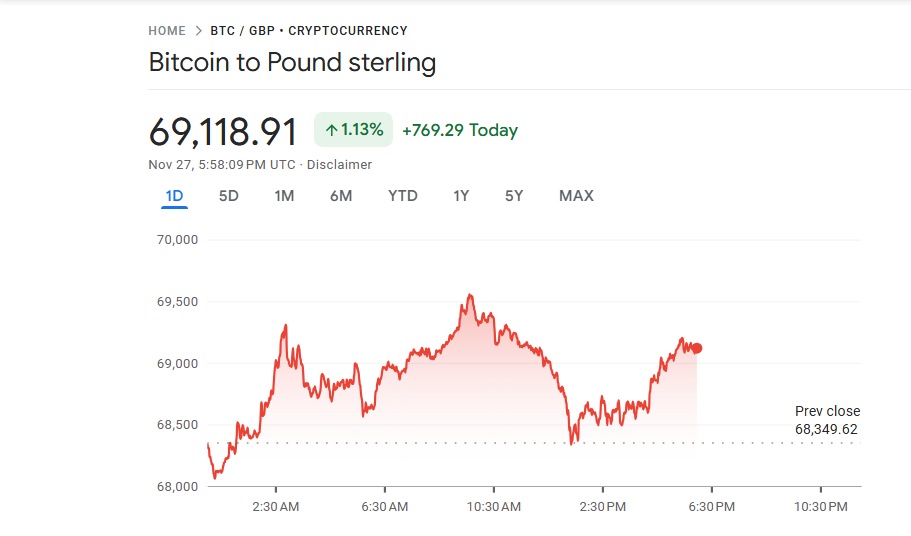

BTC price rebounds 5% — can it hold above £69K in the UK market?

UK traders watch key support level as Bitcoin tries to stabilise

Bitcoin has staged a fresh comeback after a turbulent period, with the price rebounding around 5% and pushing back above the £69,000 mark in the UK market. The move has given traders a sense of relief as the cryptocurrency attempts to stabilise following weeks of heavy volatility and declining confidence across global assets.

The bounce came after strong buying interest returned near recent lows, suggesting investors still see value in holding or accumulating Bitcoin during dips. Many market watchers believe long-term holders are helping support the price floor, preventing deeper losses as trading sentiment shifts more cautiously.

Despite the rebound, uncertainty continues to surround crypto assets. Economic pressures including shifting interest rate expectations and risk-off sentiment in traditional markets have contributed to wide price swings. This has made the current recovery a potentially fragile one as traders assess whether the new support level can truly hold.

The £69,000 level has developed into a key psychological marker for UK investors. Holding above this zone could help restore wider confidence and attract new inflows into the market. If Bitcoin can sustain momentum, analysts believe stronger resistance levels could come back into play, offering the possibility of a more sustained rally.

Institutional interest also remains a crucial factor. Funds and larger investors returning to the market may help provide greater stability compared with earlier cycles. When volumes increase meaningfully, moves higher tend to hold more convincingly, which could help protect Bitcoin from sliding back below the threshold.

However, risks remain firmly in the picture. Profit-taking behaviour has been noticeable after every short-term recovery in recent months. Traders who bought lower may choose to lock in gains quickly, which could put downward pressure on prices again if momentum starts to fade.

Broader macroeconomic developments will continue to influence market direction. Any worsening in investor sentiment or renewed volatility across global equities could easily drag Bitcoin lower. Crypto remains highly sensitive to these shifts, making the next few trading sessions particularly important for establishing confidence.

Some analysts argue that this rebound is a healthy sign of underlying demand. They suggest that repeated recoveries indicate strong conviction among core buyers who view Bitcoin as a hedge or long-term store of value, especially during uncertain economic periods. This could help reinforce price floors in the months ahead.

For short-term traders, the focus remains on whether support levels can hold as trading ranges tighten. A failure to keep the price above £69,000 could trigger a renewed downturn, while a strong push further upward may encourage more bullish expectations and fresh buying activity.

For now, the situation remains finely balanced. Bitcoin has shown resilience by climbing back from recent pressures, but must prove it can sustain that recovery in the face of continued market uncertainty. UK investors will be watching closely to see whether the world’s largest cryptocurrency can remain above a level that has quickly become its latest test of strength.