Bitcoin’s sharp bounce boosts UK retail trading volumes

Renewed crypto confidence sends British traders back into the market

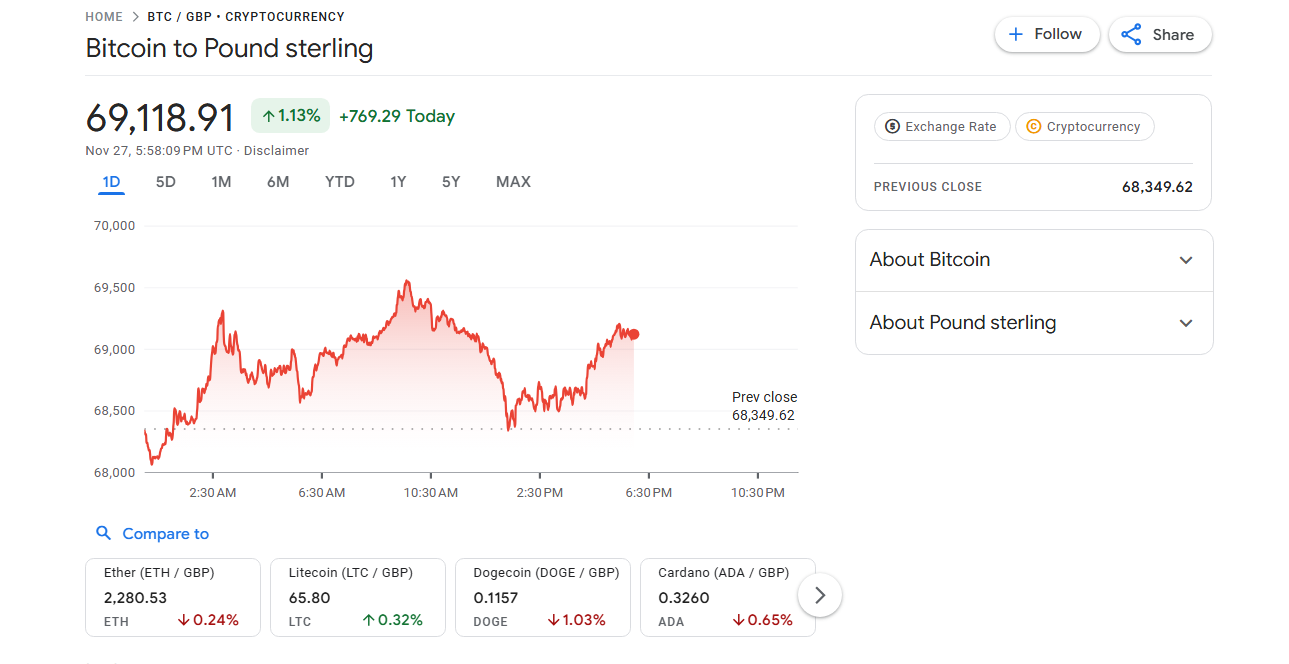

Bitcoin’s surge in recent weeks has triggered a marked rise in retail trading activity across the UK, signalling a renewed appetite for cryptocurrency after months of subdued sentiment. The sharp rebound in Bitcoin’s price has encouraged individual investors back onto trading platforms, pushing up volumes and boosting liquidity across digital assets. Exchanges operating in the UK report that engagement from everyday traders is climbing rapidly.

The rally follows a steep correction earlier this year that wiped out billions from the cryptocurrency market, but the latest upward momentum has reversed a large portion of those losses. Bitcoin climbing well above the $100,000 mark has reassured many investors who had been waiting for a clear direction before re-entering the market. This bounce has become a catalyst for heightened activity from both short-term traders and long-term crypto adopters.

UK trading platforms offering exposure to Bitcoin have recorded a surge in daily buy and sell orders, particularly from customers who had paused activity during the downturn. The rise is especially evident on platforms that provide access to regulated crypto investment products, which are now widely available to retail users. Analysts say greater ease of access is shaping the way British investors participate in crypto markets.

The introduction of Bitcoin-linked financial products on UK exchanges earlier this year appears to be a major contributor to this spike. Retail traders who previously relied on offshore exchanges or unregulated apps now have domestic choices overseen by UK financial rules. This shift toward regulated market access is believed to have boosted confidence and helped pull more retail participants back into the sector.

Brokers have also noted a wave of new account activations from retail users looking to add crypto exposure to their portfolios. Although not every platform discloses full figures, several report that trading activity jumped sharply following Bitcoin’s rebound. The trend suggests that UK retail investors are once again treating cryptocurrency as a serious part of their investment mix alongside stocks and other asset classes.

Market analysts have pointed out that Bitcoin’s movement often influences broader retail participation across financial markets. When the flagship cryptocurrency rises, trading volumes tend to increase not just in Bitcoin but across other digital assets and speculative markets. This pattern is currently visible in the UK, where elevated crypto activity is coinciding with stronger engagement in equities and forex trading.

Institutional interest has also played a role in restoring confidence among British retail investors. Major financial institutions increasing their involvement in crypto markets has helped stabilise perceptions of digital assets as a maturing sector. Momentum in institutional investment is seen by many retail traders as a signal that the market may have entered a more secure phase, encouraging them to follow suit.

Despite strong interest, UK investment platforms continue to advise customers to remain cautious due to the volatility of crypto markets. Financial advisers warn that although Bitcoin has posted solid gains recently, price swings can still be sudden and steep. The message has not dampened enthusiasm significantly, but it has prompted some investors to balance crypto exposure more carefully within wider portfolios.

Payment trends also suggest that younger investors remain at the forefront of the latest push into Bitcoin. Trading data indicates that users aged 18 to 34 are driving a large portion of the renewed activity, supported by the growth of mobile-based investment platforms. However, participation from older demographics has also increased compared with previous rallies, highlighting a broader shift in adoption.

Looking ahead, the outlook for retail trading volumes in the UK will depend heavily on whether Bitcoin can maintain its upward trajectory. If the price continues to strengthen and institutional inflows remain consistent, analysts expect retail participation to stay elevated throughout the year. For UK investors, the challenge will be navigating the excitement of the rally while managing the financial risks that historically accompany Bitcoin’s rapid climbs.

Also Read: UK Budget 2025 slashes salary-sacrifice pension perk to £2,000